Find the best Duncan mortgage rates. Online Duncan brokers like Breezeful are your best source for the most competitive rates. We can answer your questions and provide you with an overview of the rates and options offered by lenders and banks in Duncan, British Columbia and across Canada.

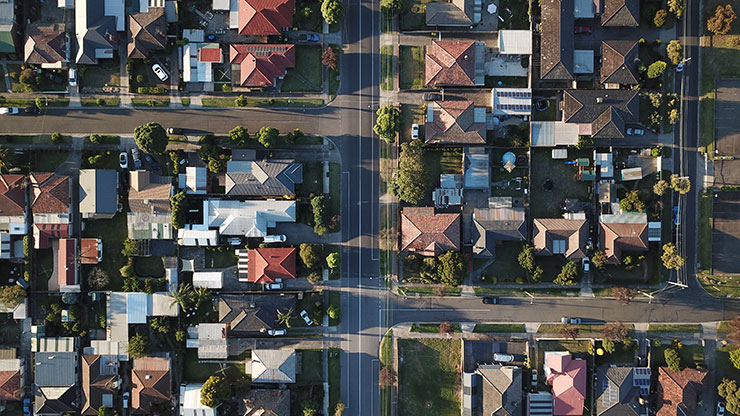

Duncan, British Columbia is the perfect place to call home. 4,932 people currently live in single family homes, condos and townhouses in this lively Canadian city, and an increasing number are relying on local mortgage brokers to discover the best rates and lenders for their home-buying needs. Real estate is spread across 2.07 square kilometers, alongside many popular arts, culture and recreation facilities.

Duncan, British Columbia Pre-Approval

Mortgage pre-approval is written documentation that states you are qualified for a mortgage loan amount under a specific term and interest rate. Once you get a pre approval you'll know the maximum amount you can qualify for, what your mortgage payments could be and lock in your interest rate for a certain amount of time.

It's important to be pre approved before you start your home search so that you know how much you can afford.Duncan realtors will take you seriously if you approach them with your pre approval documentation.

You can get a pre approval from a mortgage broker or a lender in British Columbia. We recommend going with a broker like Breezeful because we can shop the best rate amongst thousands of mortgage products.

Pre approvals are often confused with prequalifications. Prequalifications are rough estimates for what you can afford while pre approvals are more accurate because your personal finances are more closely looked at.

More about British Columbia Rates and Mortgages

The Financial Institutions Commission of British Columbia plays an important role in establishing the standards for mortgage professionals in the province. Local organizations like FICOBC protect the integrity of the industry and ensure that the mortgage professionals in BC are sufficiently educated and participating in sound broker practices. Perhaps most importantly, they protect home buyers from misconduct under the Mortgage Brokers act.

The most popular places to get a mortgage in British Columbia these days are in cities like Vancouver, Surrey, Burnaby, Richmond and Abbotsford. In total, 4.6 million residents call the province home — a number that has quite literally doubled since the mid 1970s! This, along with a mild climate, strong economy, and an endless supply of incredible terrain for outdoor enthusiasts to explore, help explain why it's one of the most expensive real estate markets in Canada these days.