Looking for the best San Jose mortgage specialist? Contact a local mortgage professional like Breezeful; they are your best source for local mortgage options. Breezeful can help you with San Jose pre approvals and refinancing to get you the best mortgage.

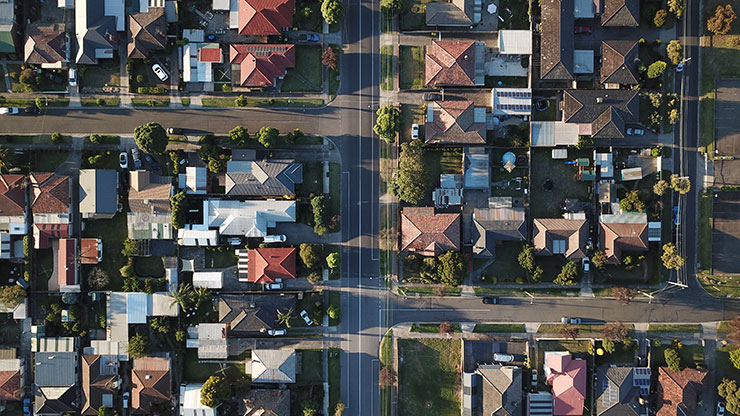

San Jose, California is the perfect place to call home. 1,013,240 people currently live in single family homes, condos and townhouses in this lively American city, and an increasing number are relying on local specialists like Breezeful to discover the best rates and lenders for their home-buying needs. Real estate is spread across 178.3 square kilometers, alongside many popular arts, culture and recreation facilities.

What About San Jose Mortgage Brokers?

Buying a home can be a complex process, especially if you're looking to buy or refinance a home in San Jose, California. Fortunately, there are plenty of local real estate and mortgage professionals available to help home buyers navigate the process and explore all the options that are available to them. Here are just a few reasons you might want to consider using a San Jose mortgage broker for your next home purchase.

- San Jose mortgage broker live and work alongside your family. There's no substitute for local context, and these mortgage professionals have a ton of context about what mortgage products, rates and lenders are best suited for your needs.

- While banks provide a limited range of rates and mortgage products, mortgage brokers are able to pull way more information from a wide range of financial institutions on your behalf. Some can even pass along volume discounts!

- If you're checking rates by yourself, your credit report needs to be accessed multiple times. Mortgage brokers, however, can access all the information available to you with a single credit report.

- They can simplify a complex process by sharing access to their established network of trusted real estate professionals. Often San Jose mortgage brokers can provide introductions to helpful contacts like local home insurance agents, inspectors, architects, home stagers, renovation companies and more!

- It's totally free! If you successfully get a mortgage, the lender will pay the mortgage broker for their help in the transaction. You'll never pay a dime!